Banking Made Easy: Open an Account in Rotterdam

6 months ago

Rotterdam, the bustling port city in the Netherlands, is not just known for its stunning modern architecture and vibrant cultural scene. It's also a fantastic place to live, work, and study. As you settle into this dynamic city, one of the first things you'll need to do is open a bank account. Whether you're an expat, a student, or just a visitor planning an extended stay, having a local bank account can make life significantly easier.

Opening a bank account in Rotterdam is a straightforward process, but it can be daunting if you're unfamiliar with the Dutch banking system. Fear not! This guide will walk you through everything you need to know about setting up your financial life in Rotterdam. From choosing the right bank to understanding the documentation required, we've got you covered.

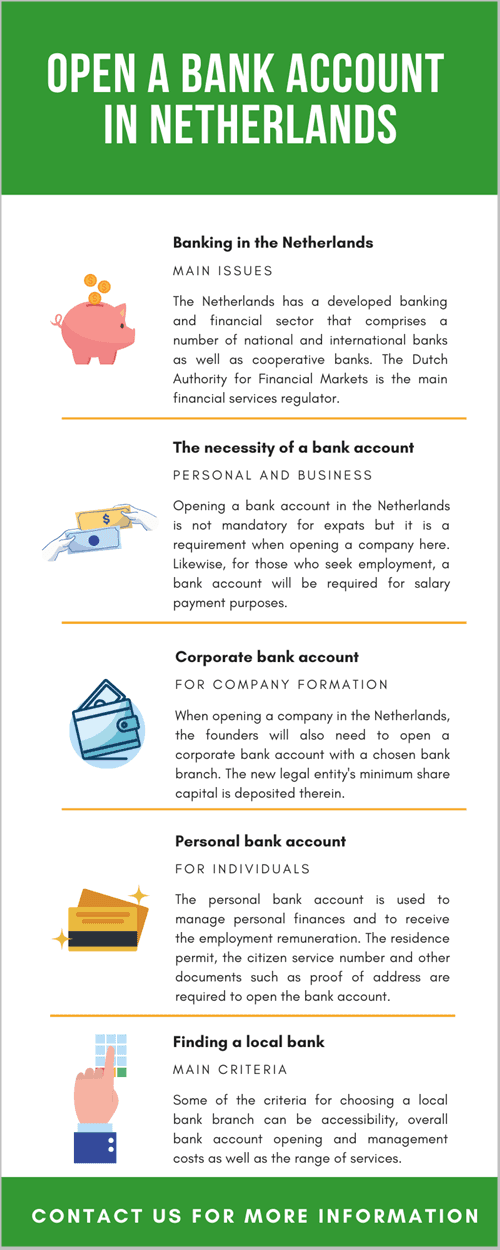

Choosing The Right Bank In Rotterdam

When it comes to banking in Rotterdam, you have several options. The city is home to a variety of banks, each offering different services that cater to various needs. The major banks include ING, ABN AMRO, and Rabobank, all of which have branches conveniently located throughout the city.

Choosing the right bank depends on what you're looking for. If you prioritize convenience and digital services, ING might be your best bet with its user-friendly mobile app and online banking services. ABN AMRO is known for its excellent customer service and support for expats, offering English-language services to make your transition smoother. Rabobank is a great option if you're interested in community banking and supporting local initiatives.

It's a good idea to visit a few branches and talk to the staff to get a feel for the service and options available. Most banks offer similar basic services, but the little differences can make a big impact on your experience.

Understanding The Types Of Accounts Available

Once you've chosen a bank, the next step is to decide on the type of account that suits your needs. Most banks in Rotterdam offer two main types of accounts: current accounts and savings accounts. Each has its own benefits and is designed for different purposes.

A current account, known as a betaalrekening in Dutch, is essential for everyday transactions. This account comes with a debit card and allows you to pay bills, receive salary deposits, and make purchases. It's the go-to account for daily use and managing your finances.

On the other hand, a savings account, or spaarrekening, is designed to help you save money. These accounts typically offer higher interest rates compared to current accounts and are perfect for storing funds you don't need immediate access to. Some banks offer additional features, such as goal-setting tools, to help you save for specific purposes.

Documentation You Will Need

Opening a bank account in Rotterdam requires a few key documents. Having these ready will streamline the process and get you set up quickly. The requirements are generally straightforward, but it's essential to ensure you have everything in order.

Here is a list of documents you will typically need:

- Identification: A valid passport or EU/EEA national ID card.

- Proof of Address: This can be a rental contract, utility bill, or municipal registration (BSN number).

- Proof of Income: Recent payslips, employment contract, or a statement of income if self-employed.

Some banks may require additional documentation, especially if you are an international student or self-employed. It's a good idea to contact the bank beforehand to confirm the exact requirements.

Step-By-Step Guide To Opening Your Account

With your documents in hand, you're ready to open your bank account. Here's a step-by-step guide to help you through the process:

"The secret of getting ahead is getting started." – Mark Twain

Step 1: Make An Appointment

While some banks offer walk-in services, it's often faster to make an appointment. This ensures that a staff member will be available to assist you when you arrive. You can typically do this online or by calling the bank's customer service.

Step 2: Visit The Branch

On the day of your appointment, bring all your required documents to the bank branch. A bank representative will guide you through the process, explaining the terms and conditions of your new account. This is a great time to ask any questions you might have.

Step 3: Set Up Online Banking

Once your account is open, the bank will provide you with details to set up online and mobile banking. This is an essential step, as it allows you to manage your finances conveniently from anywhere in the world. Ensure you download the bank's app and familiarize yourself with its features.

Tips For Managing Your Bank Account In Rotterdam

Now that your account is set up, it's time to manage it effectively. Here are some tips to help you make the most of your banking experience in Rotterdam:

- Stay Informed: Keep an eye on your account balance and transactions through your bank's app or online portal. This helps you stay on top of your finances and avoid any unexpected fees.

- Use Dutch Payment Systems: Familiarize yourself with local payment systems like iDEAL, which is widely used for online shopping in the Netherlands.

- Set Up Alerts: Most banks offer the option to set up notifications for transactions, low balances, or unusual activity. These alerts can help you monitor your account closely.

Managing your bank account effectively ensures a smooth financial experience while living in Rotterdam. It's all about staying organized and making use of the tools provided by your bank.

Frequently Asked Questions

Opening a bank account in a new country can raise several questions. Here are some of the most common queries and their answers:

Can I Open A Bank Account As A Non-Resident?

Yes, you can open a bank account in Rotterdam as a non-resident. Most banks offer accounts specifically designed for expats and international students. However, the documentation required may vary slightly, so it's best to check with the bank for specific requirements.

Are There Fees For Maintaining A Bank Account?

Most banks charge a small monthly fee for maintaining a current account. This fee covers basic services like account management and debit card usage. Savings accounts typically do not have maintenance fees, but it's always good to check the bank's fee structure before opening an account.

Can I Use My Dutch Bank Account Abroad?

Yes, you can use your Dutch bank account and debit card abroad. However, it's important to notify your bank before traveling to ensure your card works seamlessly in other countries. Be aware of any foreign transaction fees that may apply.

With this comprehensive guide, opening a bank account in Rotterdam should be a breeze. Embrace the convenience and ease of managing your finances in this vibrant city, and enjoy all that Rotterdam has to offer!

Leave a Reply